The information you need to make your sustainability ambitions a reality

In this edition

- Transitioning to a Circular Plastics Economy: Opportunities for Canada

- Shaping the ESG Revolution: The Role of the Fixed Income Markets

- Closing the Sustainable Finance Talent Gap

- Podcast: Why Nuclear is an Important Piece of the Climate Puzzle

- Sustainability Deal Announcements

CIBC to help advance sustainable business opportunities for First Nations in Canada

The First Nations Major Projects Coalition (FNMPC) has announced CIBC as a new member of its Sustaining Partners Program. The program furthers FNMPC’s ability to advance relationships between its members and the private sector on issues of mutual interest. CIBC, along with existing program members, will benefit from an exclusive relationship with FNMPC that will be focused on advancing progressive Indigenous business initiatives between the partners and FNMPC members.

Canadian financial institutions use scenario analysis to assess climate transition risk

In November 2020, the Bank of Canada and the Office of the Superintendent of Financial Institutions (OSFI) launched a Climate Scenario Analysis pilot to develop scenarios that will help the financial system identify, measure and disclose climate-related risks. The project involved the collaboration of six Canadian Federally Regulated Financial Institutions (FRFIs) – two banks, two life insurers and two property and casualty insurers. The analysis focused mostly on the Canadian and US exposures of these financial institutions, and covered the 10 most emission-intensive sectors in the economy.

A few key insights:

- Financial impact can depend on how a sector is affected in the transition. This can be through their GHG emissions, capital expenditure costs and how the demand for their products is affected by decarbonizing economies.

- The timing of taking action on transition risk is important, a delayed action by waiting until 2030 would have a negative 1% impact on Canada’s GDP by mid-century.

- Financial institutions voiced the need to develop and standardized methodologies for climate risk assessment and to improve the availability of climate-related data.

Listen in on the latest episode of the Sustainability Agenda where Dominique Barker chats with CIBC’s Ian Pollick, Managing Director & Head of Fixed Income, Currency & Commodities Strategy about the recent Bank of Canada and OSFI Climate Scenario Analysis, the key takeaways of the analysis and the impact delayed climate action has on the Canadian economy.

Listen here

Read more

Back to top

Closing the sustainable finance talent gap – An essential piece for Canada’s transition to a low carbon economy

Deloitte Canada along with Toronto Finance International (TFI) and the United Nations-convened Financial Centre for Sustainability (FC4S) recently released a report finding a growing gap between the current skills in sustainable finance to those that are needed in the future.

The report revealed 12 key insights, including:

- The Canadian financial services industry understands the importance of having a workforce equipped with sustainable finance skills; all survey respondents agree that developing these skills within their organizations is important.

- Sustainability skills are short in supply; 68% of respondents’ organizations are impacted by the sustainable finance skills shortages with 85% of those respondents experiencing the talent shortage, and indicating the impact is either moderate or significant to their organization.

- Sustainability teams are composed of multidisciplinary talent with people holding various degrees. With that, a challenge exists with recruiting sustainable finance talent as 43% of respondents experienced difficulties in recruiting experienced staff for these roles.

Bridging the gap between private capital and SMR commercialization

The Conference Board of Canada released a report on financing Small Modular Nuclear Reactors (SMR) to commercialization. According to the International Energy Agency (IEA), an average of 15 gigawatt electrical (GWe) of new nuclear energy capacity must be developed each year until 2040 in order to build a net-zero energy system by 2050.

Canada has a growing strength in the SMR ecosystem, however it suffers from a significant investment gap. Vendors operating in Canada have only raised between $10 million and $50 million in private investment while estimates indicate a US$1 billion cost to reach the stage of first construction, and another US$2-3 billion for the construction of a grid-scale SMR plant.

SMR vendors face challenges in accessing early-stage financing from traditional sources like venture capital due to: 1) expensive risk – the development of clean technologies involves new innovation, high investment costs and technology risk; 2) long-term returns – a typical venture capital fund operates for 10 years while clean technologies can take 10+years to commercialize; 3) fitting into the market – many investors remain skeptical that SMRs will produce electricity at competitive rates particularly in deregulated markets. Due to these challenges, SMR development in Canada, US, and the UK are sourcing investments from high net-worth individual investors – family offices – and corporate partnerships with engineering, procurement, and construction (EPC) firms.

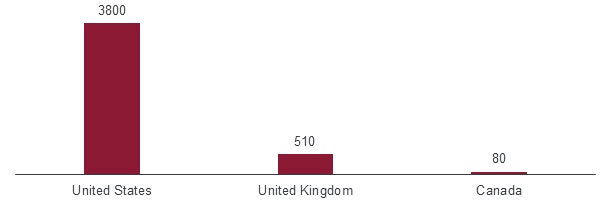

Canada’s approach to SMR commercialization is poor when comparing to peer countries. Canada has a significantly smaller funding level and less strategic programs. SMR vendors require long-term strategic government programs that reduce risk and crowd-in patient capital. In order to accelerate private investments towards SMRs, the federal government needs to develop a more ambitious strategy that addresses funding barriers and shares risks and returns across the full commercialization pathway. Maybe this is an area for blended finance?

Canada’s public SMR investment isn’t keeping pace with peer countries (total investment, US $ millions)

Note: Figures for the US and the UK represent funding issued or earmarked under the US Advanced Reactor Demonstration Program and the UK Advanced Nuclear Fund, both initiated in 2020. Figures for Canada represent all funding committed by federal and provincial governments for SMRs to date.

Carbon credits offer an innovative way for electric vehicles to penetrate the market

CIBC recently partnered with Electric Autonomy Canada to publish an article on carbon credits and its ability to provide an innovative financing tool that can incentivize automakers to produce and sell environmentally friendly vehicles.

Historically, it has been difficult for buyers and sellers to connect on the voluntary carbon markets, and to execute transactions due to a lack of market infrastructure; but with recent developments in market infrastructure such as Project Carbon, automakers that generate voluntary credits from electric vehicle charging systems would be able to transact and sell those credits.

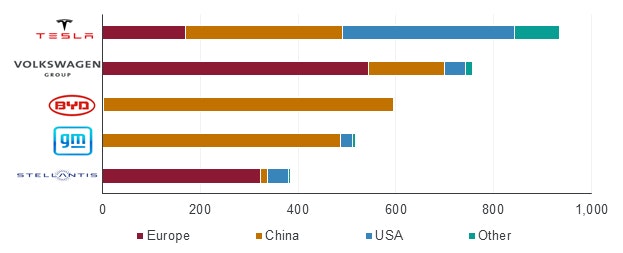

Electric vehicles sold by automakers in 2021

Note: In thousands of vehicles. Preliminary EV volumes data.

Source: International Energy Agency via EV-volumes.com

The opportunities for Canada to transition to a circular plastics economy and incentivize private sector investment

According to a recent report by the Conference Board of Canada, Canada’s linear plastic economy is unsustainable, with over 3 million tonnes of plastic waste produced annually and only 9% recycled. Diverting 90% of plastic waste from landfills in Canada by 2030 will require between $4.6 and $8.3 billion in facility investments.

The report analyzes four recycling processes and bottlenecks for plastic recyclers to obtain investments and scale up. In addition, it highlights the transfer of responsibility in whole or in part from municipalities to the private sector for the operation and financing of recycling programs.

The report advocates on initiatives such as developing industrial guidance, de-risking for financial access, enhancing extended producer responsibility programs and incentivizing change.

For more on circular economy and the opportunities for Canada, join us at the forthcoming CIBC Sustainability Circular Economy Roundtable scheduled for April 13, 2022. Contact your CIBC representative for more information.

Following the Science – Why nuclear energy should be included in sustainable finance

Nuclear energy and sustainable finance has a complicated relationship according to a report released by the Conference Board of Canada. On one hand, nuclear energy is a non-emitting source of electricity and on the other, has been associated with concerns to safe plant operation, weapons proliferation, and waste management. Investors have commonly used an exclusionary or negative screen for nuclear energy. Green bond standards such as the International Capital Market Association’s (ICMA) Green Bond Principles and the Climate Bond Initiative’s taxonomy do not restrict nuclear energy from the use of proceeds, however, green bond issuers often choose to exclude nuclear energy projects from eligible use of proceeds.

The eligibility of nuclear energy as a sustainable investment has been particularly controversial after the recent developments of the EU taxonomy. Specifically, the eligibility is focused on whether nuclear technology satisfies the “do no significant harm” requirement to non-climate-related environmental objectives. According to a report by the Joint Research Centre (JRC) – a science and knowledge body responsible for providing independent scientific evidence to policy makers – nuclear energy does no more harm to the environment and/or to human health than other energy generation technologies. The JRC is in favor of a risk-based approach that emphasizes safety and environmental regulation in managing and mitigating the risks of nuclear energy production.

Watch for more green bonds that include nuclear energy in future.

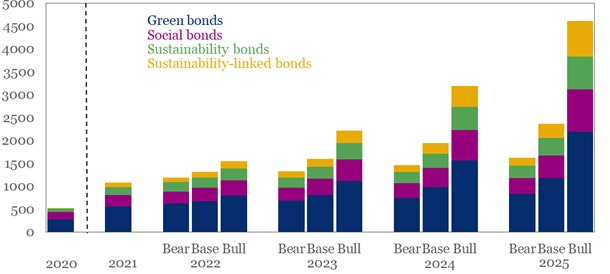

The fixed income markets’ role in shaping the ESG revolution – ESG bond market projected to reach US$4.5 trillion by 2025

The Institute of International Finance (IIF) in partnership with Pictet Asset Management released a report and hosted a webinar – Bonds that Build Back Better: The Pivotal Role of Fixed Income Markets in the ESG Revolution – to examine the landscape of the ESG-labelled bond markets and analyze the role of corporates, ESG funds and supranationals in building a sustainable economy. A few key insights include:

- Global sustainable debt issuance was approximately $1.4 trillion in 2021, with projections to reach over $4.5 trillion by 2025.

- To achieve net-zero by 2050, they estimate the outstanding volume of climate-aligned ESG bonds to reach $60 trillion by 2030, equivalent to one third of the global bond market.

- ESG bonds are growing at the same pace as the climate commitments set by companies.

According to a panelist, nuclear technologies can satisfy the “do no significant harm” basic requirement in the EU Taxonomy which makes it a strong contender as a green investment label. Natural gas, on the other hand, is needed as a transitional tool to meet the Paris Agreement’s global climate goals but shouldn’t be considered “green” under the EU taxonomy, as a 270g of CO2e per kilowatt hour (kWh) threshold goes against the scientific community.

ESG-labelled bond issuance forecast ($ billion)

Source: The Institute of International Finance (IIF)

Net-zero emissions by 2050 isn’t only an aspirational goal, it’s an economic growth imperative

Deloitte Economics Institute released a report that shows accounting for the impact of climate change is an economic growth imperative, based on economic modeling from Deloitte’s Regional Climate Integrated Assessment Computable General Equilibrium Model (D.Climate).

A few key insights:

- Over the last 50 years, the US has suffered a total of $1.4 trillion in economic losses due to weather, climate, and water hazards – one third of the cost of all global economy losses are due to disasters. The report indicates that insufficient climate action could cost the U.S economy up to $14.5 trillion and nearly a million jobs by 2070.

- By accelerating decarbonization, the US could complete an industrial revolution in only 30 years, a feat that could result in a 2.5% increase in annual GDP by 2050.and a $3 trillion increase in GDP by 2070.

- The analysis shows that the net cost of the transition could be 0.1% of US GDP per year on average to 2050, or an average economic cost of approximately $35 billion annually.

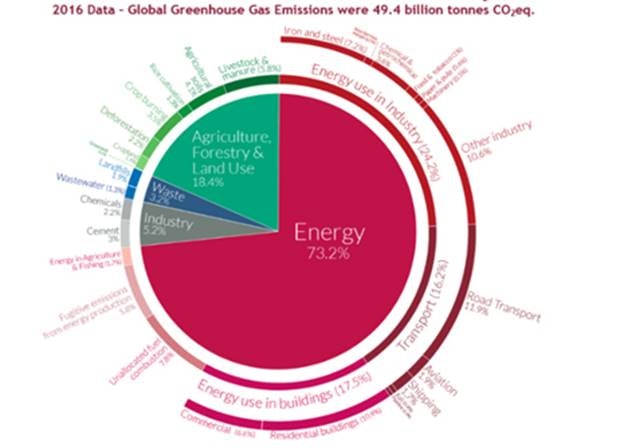

Global greenhouse gas emissions by sector

Source: Visuals from OurWorldinData.org; data from Climate Watch, the World Resources Institute (2020)

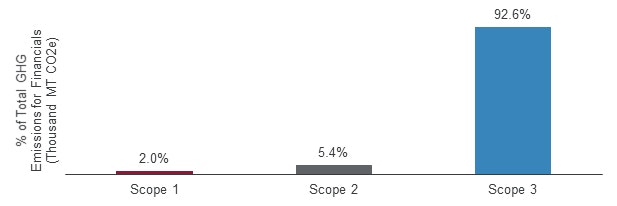

Reducing financed emissions – the largest opportunity for financial institutions to improve climate risks

RP Investment Advisors (RPIA) – a fixed income manager with expertise in corporate bonds and active interest rate management – released a piece on the role of financed emissions on the path to net-zero. A recent study by the Carbon Disclosure Project shows that scope 3, financed emissions of reporting institutions is approximately 700 times larger than their operational emissions. Reducing scope 3 provides the largest opportunity for financial institutions to improve climate risks. According to RPIA, targets are most credible when: (1) methodology is consistent with the Partnership for Carbon Accounting Financials (PCAF); (2) interim targets are included and not just stated as a “net-zero by 2050” commitment and; (3) industry-specific goals are informed by scientific pathways.

Engagement is often seen as an equity investor’s domain but fixed income investors can and should be able to influence management teams on sustainability issues. Many of the issuers in the bond market do not have publicly-traded equity and/or have larger debt footprints which need to be refinanced regularly, creating opportunities for fixed income investors to have an impact.

Financial institutions have a key role to play in decarbonization through advising their clients to transition their operations to lower-emitting activities and, in turn, reducing their scope 3, financed emissions.

Greenhouse gas emissions for financials, by scope type

Source: RPIA

IEA’s energy policy recommendation for Canada

The International Energy Agency (IEA) recently published the Canadian edition of the Energy Policy Review – a publication that conducts peer reviews of the energy policies of its member countries. The last time the IEA published a report on Canada was 2015. Canada’s current and economic profile creates both challenges and opportunities in achieving our emission reduction commitments given that Canada is a major producer, consumer and exporter of energy, its northern climate and highly decentralized government system. While fossil fuels are a large component of the Canadian economy, its wealth of clean electricity and the important role of nuclear can provide a competitive edge.

Canada is actively advancing in a number of innovative technologies – many of which are critical to achieve net zero by 2050 – recently announcing additional support for carbon capture, utilization and storage (CCUS); hydrogen; and small modular reactors (SMRs), with a strategy of serving as a supplier of energy and climate solutions to the world. In this report, the IEA provides various energy policy recommendations to the Government of Canada to help manage the transformation of its energy sector.

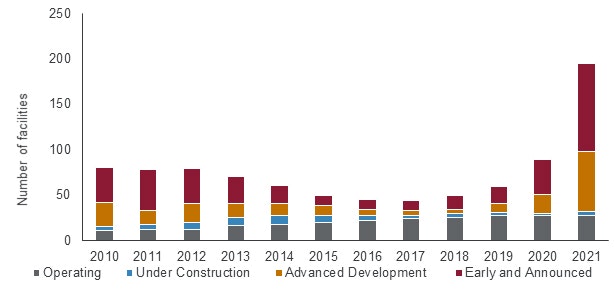

Global pipeline of commercial carbon capture, utilization, and storage facilities operating and in development, 2010-2021

Source: IEA analysis and tracking; Global CCS Institute CCS Facilities Database

Biden-Harris Administration launches Building Performance Standards Coalition

On January 21, 2022, President Biden announced that his Administration is teaming up with 33 state and local governments to launch the Building Performance Standards Coalition, a partnership committed to establishing retrofit and upgrade policies by Earth Day 2024.

The US Department of Energy launches Office of Clean Energy Demonstrations

In December 2021, the US Department of Energy launched the Office of Clean Energy Demonstrations to oversee federal investments for clean energy projects across the US and help reach President Biden’s goals of net-zero emissions by 2050. The office will spend more than US$20 billion to support projects in areas including clean hydrogen, carbon capture, grid-scale energy storage, and small modular reactors, in order to fill an innovation gap on the pathway to net-zero emissions by 2050.

Sustainability across CIBC

Deal announcements

In line with our commitment to make sustainability a reality for our clients and the communities we serve, CIBC Capital Markets led significant client deals and provided sustainability advisory as part of a focused objective to help our clients become global leaders in environmental stewardship and sustainability.

Blackstone Infrastructure Partners

Financial Advisor to Blackstone on its ~US$3B investment in Invenergy to accelerate renewable development activities.

Hydrostor Inc.

Financial Advisor to Hydrostor on its ~US$250MM investment from Goldman Sachs Asset Management.

Cogeco Inc. and Cogeco Communications Inc.

Sustainability Structuring Agent, Joint Bookrunner and Co-Lead Arranger for the transitioning of the Cogeco Term Revolving Facilities into the first Syndicated Sustainability-Linked Loans in Canada within the telecommunications and media sectors.

Hydro One Limited

Co-Sustainability Structuring Agent, evolving Hydro One’s lines of credit into Sustainability-Linked Loans; and becoming the first Canadian organization to incorporate sustainability performance measure based on increasing indigenous procurement spend.

European Investment Bank (EIB)

Joint Bookrunner on a $1.4B re-opening of the EIB’s 3-year Climate Awareness Bonds.

CIBC Events

Upcoming event

CIBC Sustainability Circular Economy Roundtable: Enabling the Ecosystem

Wednesday, April 13, 2022

What is circular economy? Why is transition towards circular economy important to tackle climate change and develop resilience for our economies? What are the opportunities to advance circular economy in Canada? Join us at the roundtable to discuss these and more.

For more information, please contact your CIBC representative.

Publications

The Sustainability Agenda

CIBC Capital Markets’ podcast series focusing on the evolving complexities of the sustainability landscape – with a view to addressing current issues in a concise format to help you navigate and take action.

In conversation with Bruce Power – Why nuclear is an important piece of the climate puzzle

Episode 21, 27 minutes

A discussion on nuclear energy and the vital role it plays in achieving net-zero by 2050, featuring CIBC’s Dominique Barker, in conversation with Bruce Power’s Kevin Kelly, Chief Financial Officer and EVP, and James Scongack, Chief Development Officer and EVP, Operational Services.

The Raitt Stuff – Chemistry, Canada and a net-zero economy

Episode 16, 14 minutes

The Hon. Lisa Raitt in conversation with Bob Masterson, President & CEO of Chemistry Industry Association of Canada (CIAC), discuss the relationship between the chemistry industry and a net-zero economy; transitioning to a circular economy and Canada’s role in the chemistry industry, as well as the CIAC’s Responsible Care Program.

CIBC Capital Markets Insight Portal

Your one-stop destination for thoughtful and timely insights on today’s most critical issues.

Stay informed. Follow CIBC Capital Markets on Twitter and LinkedIn.